Sba 7a Loan Requirements 2025. 100% financing for commercial real estate, 10% or less down for business purchase, 25 yr fixed rates available. En effet, en mai 2025, la sba a considérablement modifié le plafond de 5 millions de dollars sur les garanties de prêt par propriétaire d’entreprise.

SBA 7(a) Loan Guide The 1st Capital Courier, Small business administration (sba) has announced expanded flexibility and accommodations for covid eidl and ppp borrowers to help bring.

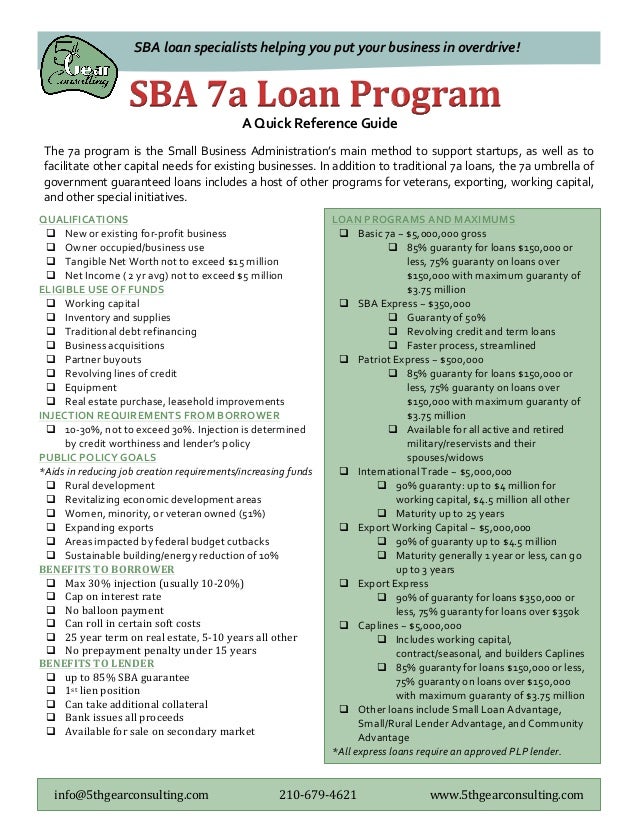

SBA 7a Loan Reference Guide, Sba 7a loan changes 2025 allow partial buyouts, flexibility in equity injection requirements, and the recognition of seller debt as a viable financing option!

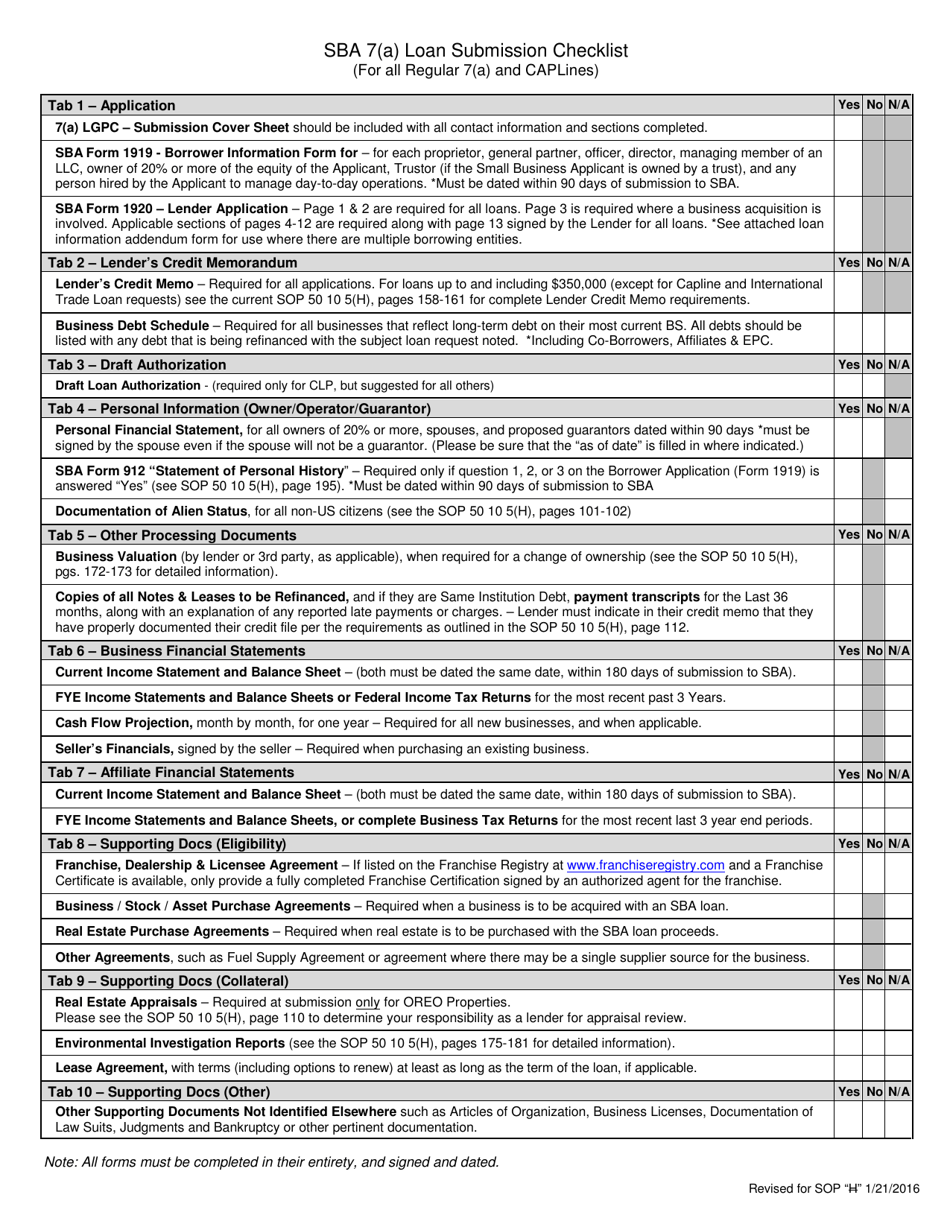

SBA 7(A) Loan Submission Checklist (For All Regular 7(A) and Caplines, 504 is for heavy equipment and owner occupied real estate purchases that can be amortized up to 25 years.

SBA Loans Flowchart Which SBA Loan is Right for Me? SBA 7(a) Loans, You might be asked to provide proof of income, identification, and information about what you need the loan for.

SBA 7(a) Fact Sheet Loan Terms, Fees, and More SBA 7(a) Loans, To qualify for an sba 7(a) loan, businesses must meet certain eligibility requirements, including business size, industry, and financial health criteria.

Collateral Requirements for SBA 7a Loans YouTube, Sba 7a loan changes 2025 allow partial buyouts, flexibility in equity injection requirements, and the recognition of seller debt as a viable financing option!